1 in 6 English properties at risk of flooding by 2050

Download Research reportDownload Research report

Published in March 2023, the Bayes Business School Research Report analyses the impact of flood risk on England’s property market. Revealing that 1 in 6 properties in England will be at risk of flooding by 2050, the research is a stark illustration of the extent to which climate change and the increasing frequency of extreme weather events are affecting the property market.

A 3-way collaboration between Bayes Business School, Rightmove and Twinn, the report analysed the 4.8 million Rightmove listings and 3.2 million completed transactions that took place between 2006 and 2021. Leveraging property price data from Rightmove and Twinn climate risk data from FloodScore (our unique scoring methodology, formerly under the Ambiental brand), the report quantifies current and future flood risk.

In this article, we summarise the research’s key findings, explore its implications for the property market – from lenders and insurers to policy makers and regulators – and outline our response.

A 3-way collaboration between Bayes Business School, Rightmove and Twinn, the report analysed the 4.8 million Rightmove listings and 3.2 million completed transactions that took place between 2006 and 2021. Leveraging property price data from Rightmove and Twinn climate risk data from FloodScore (our unique scoring methodology, formerly under the Ambiental brand), the report quantifies current and future flood risk.

In this article, we summarise the research’s key findings, explore its implications for the property market – from lenders and insurers to policy makers and regulators – and outline our response.

Flood risk has a significant impact on saleability

Authored by Dr Alexandros Skouralis and Dr Nicole Lux, the key takeaway from the Bayes Business School report is that flood risk impacts the saleability of properties – increasing the value of those exempted from risk while devaluing properties with a higher probability of being affected. Researchers found that residential properties at risk of flooding are sold at a 8.14% discount – with the level of discount strongly correlated to the probability of flood risk.

In addition, the report revealed that:

- Around half of affected properties can be characterised as high flood risk

- While flood risk is never the main driver of a sale, zero exposure increases the saleability of a property from 63.3% to 65.6%

- At highest risk from flooding are properties in East Anglia, the northwest of England and Yorkshire, where 13-18% of properties are exposed

- Property-level flood risk is projected to increase by 8% between 2050 and 2080 – with a 1% increase in flood risk leading to a decline of 0.11-0.19% in sold and asking price

- The effect of flood risk is asymmetric, with lower-priced properties more sensitive – moreover, semi-detached and terraced houses are more vulnerable to flooding

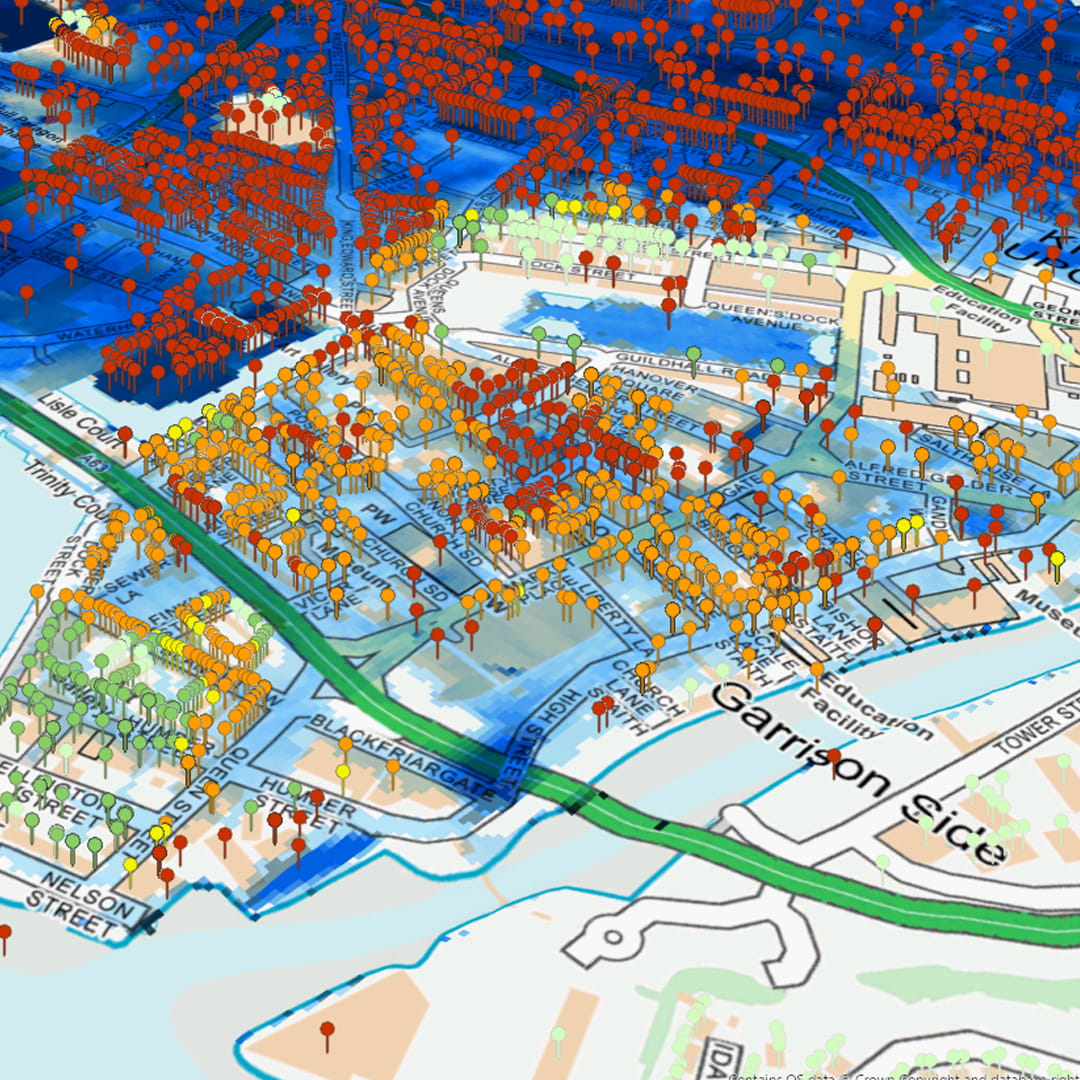

This image shows Twinn's Flood Map fluvial data in blue. Twinn Flood Score data points are overlaid, colour coded to describe the flood risk to properties, with red representing locations with very high flood risk predicted.

Report

Research Report: The Impact of Flood Risk on England's Property Market

Thanks to the data and methodology, the research overcame the limitations impacting previous studies

Previous research into the impact of flooding on property prices has been limited by several factors. For example, the Belanger & Bourdeau-Brien 2018 report captured flood risk based on a property’s distance from water. However, the McKenzie & Levendis 2010 study of Hurricane Katrina found that property elevation was an important factor in determining risk.In addition, separating the price impact of a potential flood risk from the property price has challenged earlier projects: while properties close to the coast have a higher risk of flooding, coastal locations often attract a price premium which outweighs the risk of a future flood event.

By leveraging Twinn climate risk scoring methodology and Rightmove property price data, the Bayes Business School researchers unlocked new and detailed insights into the dynamics between flood risks and property prices in England. Overcoming limitations encountered by previous studies, the research presents evidence of flood risk price effects on residential properties at an individual level.

Sophisticated and precise, our methodology enables quantification of the likelihood of pluvial, fluvial and tidal flooding at property level based on different emissions scenarios. As such, the report marks a turning point for the property market.

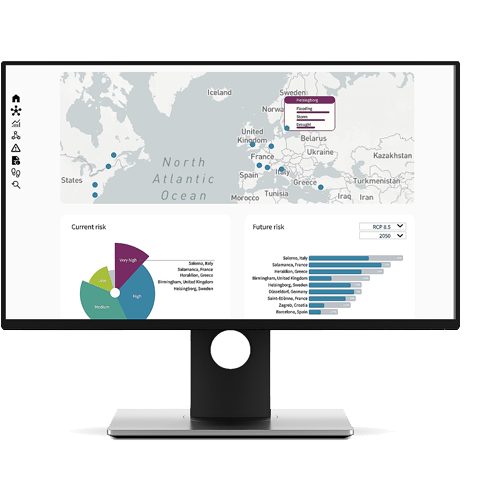

Twinn Climate Intelligence Platform

The research highlights the importance of incorporating climate change-adjusted data into modelling

The Bayes Business School analysis confirms the financial impact of flood risk – and how important it is that lenders, insurers and homeowners factor it into their decision-making. “This analysis shows that we can begin to quantify the likely impact on devaluation of properties due to flood risk,” said Rob Carling, Channel Sales Manager at Twinn.Crucially, the report highlights the importance of accurate, up-to-date data in flooding modelling. “Of course, it is vital to incorporate historic events,” Rob continued. “However, focusing exclusively on historic data limits our vision and perception of the risk, which is increasing significantly now we’re in the era of climate change.”

At Twinn, our climate risk intelligence platform is based on proprietary IP developed over 20 years. By combining high-resolution natural hazard data with machine learning, climate exposure analysis and risk-scoring systems, we provide clarity on future flood risk.

“Data accuracy is key,” confirmed Rob. “When you work primarily with historic data, rather than incorporating climate change adjusted values, it can result in an underestimation of the actual effects of flood risk on the property market.”

Flood risk will become increasingly significant for the property market – for policy makers, lenders, insurers and buyers

While insurers and lenders already take flood risk into account in their decision-making processes, Dr Nicole Lux – author of the report and Senior Research Fellow at Bayes Business School – believes that the research will spark action amongst policy makers. “Flood risk impact on low-income households is something national programmes from the Environmental Agency’s flood risk management plans (FRMPs) should take into account,” she said.In addition, the research demonstrates that flood risk is set to become an increasingly significant factor for lenders, insurers and buyers. “Although flood risk is largely factored into valuation at the property marketing stage, the analysis shows how it will play a more significant role in property valuations by 2050, and is likely to rise up the list of home-mover concerns,” said Ed Burgess, Strategic Manager in Data Services at Rightmove.

Access to detailed data on individual property risk across various future climate scenarios is already a must-have for conveyancers, insurers and lenders

Twinn provides detailed insight to leading organisations across the sector, enabling them to comply with shifting regulatory requirements.We partner with Groundsure to power its climate analysis tool for conveyancers – and with Hometrack to provide modelling expertise and data for its property valuation solutions for the majority of the UK’s top ten lenders, helping them comply with the Climate Biennial Exploratory Scenario. In addition, we support leading insurers across the UK with accurate climate risk data to enhance decision-making.

Want access to historic, real-time and future climate risk intelligence to help you comply with climate regulations? Get in touch.