Climate Risk Screening

Full hazard exposure assessment for any location or portfolio anywhere in the world

Get a free quick scan reportGet a free quick scan report

Why climate risk screening?

Worldwide coverage

Actionable insights

Tailored to your business

Portfolio reporting

Is your portfolio vulnerable to risks posed by current or future hazards?

Climate change is causing more frequent and more severe weather events. Shifting environmental conditions, economic forces and numerous other hazards are triggering complex cascading effects that impact business operations both directly and indirectly. As a result, buildings, facilities, products, distribution, supply chains, and people are more exposed to risk than ever before.Recent global events have shown just how severe the impacts of these hazards can be – and highlighted the need for greater hazard visibility, so organisations can prepare for them proactively to prevent negative future impacts and optimise business strategies or processes for sustainable long-term growth.

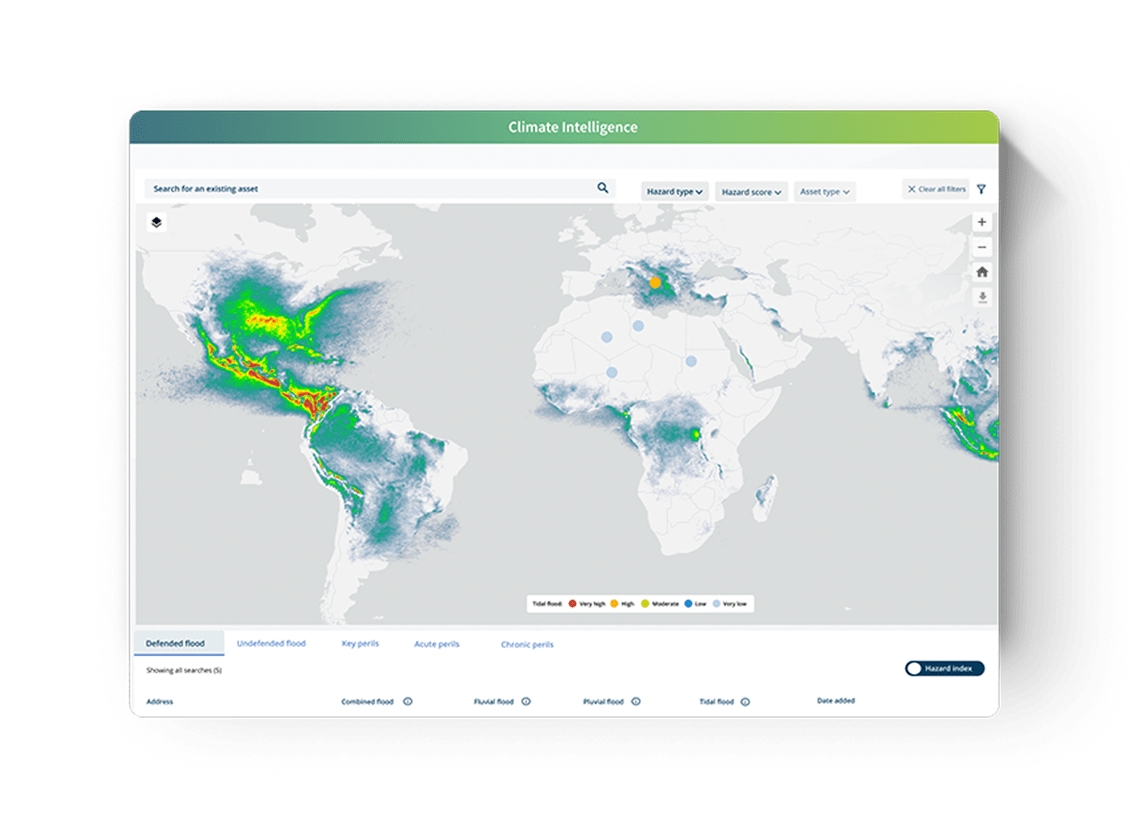

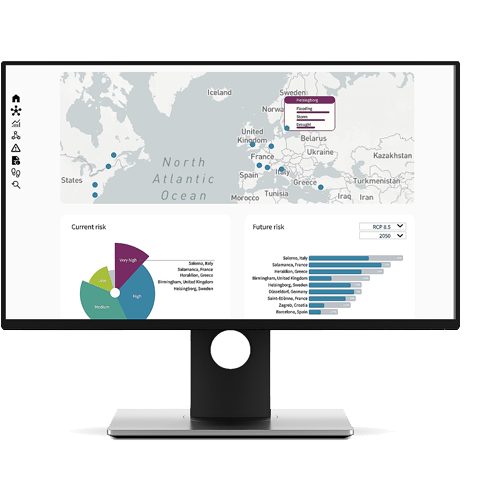

Detailed climate risk data, actionable insights

Understand the potential future changes to your assets to guide resilience/mitigation measures and ensure compliance with regulatory requirements. Twinn’s climate change risk assessment tool gives you risk scoring based on 19 hazard datasets, including floods (coastal, fluvial, pluvial), tropical storms, drought, wildfires, earthquakes, volcano activity and hail.

Importantly, we provide climate risk scores for today and various future scenarios following the Representative Concentration Pathways (RCPs) and Shared Socioeconomic Pathways (SSPs) in accordance with the latest projections from the Intergovernmental Panel on Climate Change (IPCC).

These insights not only help you better prepare for and mitigate against potential hazards but also ensure alignment with regulatory requirements such as those outlined by the Task-Force on Climate-Related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI), the Corporate Sustainability Reporting Directive (CSRD) and others.

Is there an easy way to assess climate-related physical risk to my built assets?

Yes – with Twinn’s climate risk assessment tool and methodology. Our software helps you visualise risks and identify hazards as they develop, so you can understand, predict and mitigate their impact before they cause issues

Wherever you operate and have physical assets, Twinn can provide actionable insights and analysis on climate risk exposure:

- Get data and/or risk scores for any location – across 19 hazards, down to individual addresses or site locations

- Easily incorporate the climate risk analysis into your processes – get insights via flat files, APIs or our dynamic visualisation and monitoring platform

- Plan for today and the future – our hazard data is carefully curated by our domain experts to provide you with market-leading exposure analysis and risk scoring, so you get clarity on climate risks affecting global operations now and over time

Assess your climate risks with Twinn

- Register your interest

- Once you’re registered, you will get instructions on how to upload a list of your organisation’s physical assets

- Within 1-2 business days, you will receive a Climate Risk Quick Scan Report with actionable insights on how your assets are affected by risks from climate change, natural hazards and severe weather

2 years, ago, many lenders wouldn't have known if their flood risk was 5% or 25%. Now, the majority of the top 10 UK mortgage lenders use Twinn data to quantify their exposure, helping protect the mortgages of more than 5 million households.

Support at every stage of your climate resilience journey

Climate change is putting people, assets, infrastructure, and business continuity at increasing risk. With 140 years of engineering experience, there’s a lot we at Royal HaskoningDHV can protect you from. Whether you need to engage stakeholders, quantify your climate risk profile, or design and implement a climate resilient solution, we're here to help you in your entire climate journey.Royal HaskoningDHV has more than 10 years of experience in working with AIMMS, though our Districon solutions.